Quotes :

" I made my first Investment at age eleven.

I was wasting my life up until then "

The Times of Warren Buffett :

Under Recession in 2007...

Buffett ran into criticism during the subprime crisis of 2007–2008, part of the recession that started in 2007, that he had allocated capital too early resulting in suboptimal deals. "Buy American. I am." he wrote for an opinion piece published in the New York Times in 2008

Buffett called the downturn in the financial sector that started in 2007 "poetic justice".[Buffett's Berkshire Hathaway suffered a 77% drop in earnings during Q3 2008 and several of his later deals suffered large mark-to-market losses.

Berkshire Hathaway acquired 10% perpetual preferred stock of Goldman Sachs. Some of Buffett's Index put options (European exercise at expiry only) that he wrote (sold) were running at around $6.73 billion mark-to-market losses as of late 2008.

The scale of the potential loss prompted the SEC to demand that Berkshire produce, "a more robust disclosure" of factors used to value the contracts. Buffett also helped Dow Chemicalpay for its $18.8 billion takeover of Rohm & Haas.

He thus became the single largest shareholder in the enlarged group with his Berkshire Hathaway, which provided $3 billion, underlining his instrumental role during the current crisis in debt and equity markets.

In 2008 Buffett became the richest person in the world, with a total net worth estimated at $62 billion by Forbesand at $58 billionby Yahoo, overtaking Bill Gates, who had been number one on the Forbes list for 13 consecutive years. In 2009 Gates regained the top position on the Forbes list, with Buffett shifted to second place.

Both of the men's values dropped, to $40 billion and $37 billion respectively—according to Forbes, Buffett lost $25 billion over a 12-month period during 2008/2009.

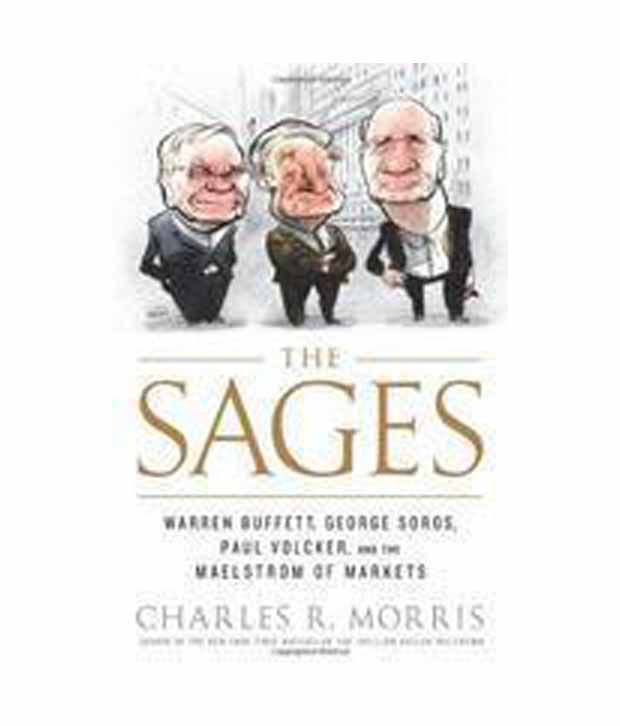

Books on Warren Buffett :

Publishers : Public Affairs

No comments:

Post a Comment