London December 30, 2009, 17:29 IST

The administrators of the European operations of the failed Lehman Brothers will return assets worth over $11 billion to the investors.

More than 90 per cent of the affected investors at Lehman Brothers International Europe are in support of the plan to return the assets.

PricewaterhouseCoopers (PwC)-- whose partners are the administrators -- today said it got the support of over 90 per cent clients for the claim resolution agreement (CRA).

The CRA, a multilateral contract between Lehman Brothers Europe and its clients, governs the basis on which assets can be returned.

"Under these arrangements, the administrators expect to return over $11 billion of the client assets," PwC said in a statement.

Lehman Brothers Europe had some $32 billion of client assets as on September 15, 2008 -- the day, when its American parent firm Lehman Brothers filed for bankruptcy in the US. Since that date, $13.3 billion has been returned.

According to the statement, the agreement allows the failed financial titan to distribute the remaining trust property during 2010.

The collapse of the famed Lehman Brothers had worsened the financial turmoil in the US which pushed the global economy into a tizzy.

Wednesday, December 30, 2009

Borrowers make merry in 2009

Kumar Dipankar/PTI / New Delhi December 30, 2009, 15:57 IST

2009 was mostly bad news for countries, governments and individuals in terms of economic prosperity, but the year was the best in many years for borrowers as interest rates eased.

Much to the delight of borrowers, home and car loan rates came down to as low as 8 per cent, the lowest in six years, during the year.

As early as February, 2009, the country's largest lender State Bank of India introduced special home loan scheme offering loans at eight per cent and by the end of the year, other big names such as HDFC and ICICI Bank had joined the rate war.

The winner, however, was the borrower.

Even car loan rates came down to 8 per cent from as high as 14 per cent in some cases. Those who were in the habit of saving, however, suffered a rude shock when peak deposit rates fell in a phased manner by 400-600 basis points.

As far as Reserve Bank's (RBI) policy rates were concerned, they remained at the lowest level as part of an effort to perk up economy.

The repo rate, the rate at which banks borrow from RBI in exchange of government bonds, was at 4.75 per cent, reverse-repo at which the apex bank accepts deposits from banks at 3.25 per cent and Cash Reserve Ratio, the portion of cash banks park with the Reserve Bank, at 5 per cent.

"The year 2009 was quite eventful for banks and it showed the resilience of the system to a huge crisis in related markets," Bank of Baroda chairman and managing director M D Mallya said.

"As we move ahead, when we shun the impact of slowdown, I expect the bank credit growth to revive considerably, which may result in upward movement of lending rates as well."

Moreover, galloping inflation is also putting pressure on the central bank to tighten monetary stance, which hitherto has been dovish.

A hike in cash reserve ratio, the percentage of amount banks should keep with RBI, will help to mop up the excess liquidity, after which RBI could start raising repo rate and reverse repo rate to exit from the easy money regime, bankers said.

At present, there is enough liquidity in the system. RBI may actually start pumping out liquidity through a CRR hike by around 25-50 basis points in January, Jammu & Kashmir Bank chairman Haseeb Drabu said.

Such move by RBI would automatically signal hike in interest rates in the system.

Interestingly, the talks on consolidation in the public sector banks began during the year as the Finance Ministry held a discussion with leading PSU banks to explore the possibility of creating a few large banks through mergers and acquisitions.

Heads of five major PSU banks -- Punjab National Bank, Bank of Baroda, Canara Bank, Union Bank of India and Bank of India -- attended the meeting called by Additional Secretary G C Chaturvedi in November.

Bankers expect the consolidation talks in the Indian banking system to gain momentum in 2010 both in public and private sectors, as it is warranted by evolving competition in the global banking space.

In a bid to strengthen the banking system, RBI proposed to increase provision coverage for the banks to not less than 70 per cent by September 2010. Increase in provision coverage could dent profits (mainly for SBI and ICICI Bank) in the next three-four quarters, an analyst said.

At the same time, a Reserve Bank panel recommended that loans should be given at interest rates that are linked to a defined minimum base rate instead of the present benchmark prime lending rate (BPLR) to ensure transparency.

Linking lending rates to base rate would address the concerns relating to growing sub-BPLR portfolio of banks, the RBI had said.

Under the proposed mechanism, all banks will be required to declare a base rate and charge interest rates over that depending upon the credit profile of the borrower and repayment period.

2009 was mostly bad news for countries, governments and individuals in terms of economic prosperity, but the year was the best in many years for borrowers as interest rates eased.

Much to the delight of borrowers, home and car loan rates came down to as low as 8 per cent, the lowest in six years, during the year.

As early as February, 2009, the country's largest lender State Bank of India introduced special home loan scheme offering loans at eight per cent and by the end of the year, other big names such as HDFC and ICICI Bank had joined the rate war.

The winner, however, was the borrower.

Even car loan rates came down to 8 per cent from as high as 14 per cent in some cases. Those who were in the habit of saving, however, suffered a rude shock when peak deposit rates fell in a phased manner by 400-600 basis points.

As far as Reserve Bank's (RBI) policy rates were concerned, they remained at the lowest level as part of an effort to perk up economy.

The repo rate, the rate at which banks borrow from RBI in exchange of government bonds, was at 4.75 per cent, reverse-repo at which the apex bank accepts deposits from banks at 3.25 per cent and Cash Reserve Ratio, the portion of cash banks park with the Reserve Bank, at 5 per cent.

"The year 2009 was quite eventful for banks and it showed the resilience of the system to a huge crisis in related markets," Bank of Baroda chairman and managing director M D Mallya said.

"As we move ahead, when we shun the impact of slowdown, I expect the bank credit growth to revive considerably, which may result in upward movement of lending rates as well."

Moreover, galloping inflation is also putting pressure on the central bank to tighten monetary stance, which hitherto has been dovish.

A hike in cash reserve ratio, the percentage of amount banks should keep with RBI, will help to mop up the excess liquidity, after which RBI could start raising repo rate and reverse repo rate to exit from the easy money regime, bankers said.

At present, there is enough liquidity in the system. RBI may actually start pumping out liquidity through a CRR hike by around 25-50 basis points in January, Jammu & Kashmir Bank chairman Haseeb Drabu said.

Such move by RBI would automatically signal hike in interest rates in the system.

Interestingly, the talks on consolidation in the public sector banks began during the year as the Finance Ministry held a discussion with leading PSU banks to explore the possibility of creating a few large banks through mergers and acquisitions.

Heads of five major PSU banks -- Punjab National Bank, Bank of Baroda, Canara Bank, Union Bank of India and Bank of India -- attended the meeting called by Additional Secretary G C Chaturvedi in November.

Bankers expect the consolidation talks in the Indian banking system to gain momentum in 2010 both in public and private sectors, as it is warranted by evolving competition in the global banking space.

In a bid to strengthen the banking system, RBI proposed to increase provision coverage for the banks to not less than 70 per cent by September 2010. Increase in provision coverage could dent profits (mainly for SBI and ICICI Bank) in the next three-four quarters, an analyst said.

At the same time, a Reserve Bank panel recommended that loans should be given at interest rates that are linked to a defined minimum base rate instead of the present benchmark prime lending rate (BPLR) to ensure transparency.

Linking lending rates to base rate would address the concerns relating to growing sub-BPLR portfolio of banks, the RBI had said.

Under the proposed mechanism, all banks will be required to declare a base rate and charge interest rates over that depending upon the credit profile of the borrower and repayment period.

No Rate Hike for 6 Months- SBI

NEW DELHI: India Inc can rejoice. State Bank of India chairman OP Bhatt on Tuesday indicated that there will be no increase in interest rates for next six months despite inflationary pressure.

As inflation is rising, the speculation is rife that RBI might take measures to tighten the money supply, leading to hardening of interest rates, in its review of monetary policy in January. As the global economy is still in the grip of recession, industry captains feel that any hike in interest rates will affect the economic recovery in India.

Bhatt said there was surplus liquidity in the system and credit offtake was slowly picking up. This situation of liquidity surplus will force banks not to increase interest rates. Because of this surplus liquidity, banks have cut deposits rates. But they are not cutting the lending rates due to slow credit offtake, despite the speculation that RBI can increase key rates (repo or reverse repo) to contain inflation.

In the eight months of the current financial year till December 4, while the deposits with the commercial banks rose by 3,69,535 crore, credit offtake was only Rs 1,44,151 crore. This forced the banks to park around Rs 100,000 crore with the RBI at reverse repo rate of 3.25%.

When the interest rate condition was benign, SBI had cut its lending rates, particularly home loan rate. Bhatt claimed that the 8% interest rate on home loan announced by SBI had helped reviving real estate market. The buyers have started coming back and cement and steel sectors have also started improving, he said. In fact, SBI's decision to cut the rates forced other banks to follow suit, he added.

Bhatt does not think Indian economy had been affected by global recession. "The recession did not hit India the way it had affected European countries last year. There was only a slowdown in the growth rate which came down to 7% from 9%," he said.

Replying to a question on withdrawal of stimulus package by the government in the prevailing situation, Bhatt said it should not be taken back but 'phased out' in staggered manner.

Referring to the ongoing merger process of SBI associate banks, Bhatt said SBI is a major stakeholder in SBI associate banks like State Bank of Saurashtra and State Bank of Indore. "In fact, we did not have less than 75% stake in any of these banks and owned 100% in State Bank of Hyderabad and State Bank of Patiala which were with us for the last 50 to 60 years," he said.

State Bank of Saurashtra has merged while process was on in regard to State Bank of Indore, Bhatt said. The merger would improve SBI in terms of efficiency in operation, release of capital.

As inflation is rising, the speculation is rife that RBI might take measures to tighten the money supply, leading to hardening of interest rates, in its review of monetary policy in January. As the global economy is still in the grip of recession, industry captains feel that any hike in interest rates will affect the economic recovery in India.

Bhatt said there was surplus liquidity in the system and credit offtake was slowly picking up. This situation of liquidity surplus will force banks not to increase interest rates. Because of this surplus liquidity, banks have cut deposits rates. But they are not cutting the lending rates due to slow credit offtake, despite the speculation that RBI can increase key rates (repo or reverse repo) to contain inflation.

In the eight months of the current financial year till December 4, while the deposits with the commercial banks rose by 3,69,535 crore, credit offtake was only Rs 1,44,151 crore. This forced the banks to park around Rs 100,000 crore with the RBI at reverse repo rate of 3.25%.

When the interest rate condition was benign, SBI had cut its lending rates, particularly home loan rate. Bhatt claimed that the 8% interest rate on home loan announced by SBI had helped reviving real estate market. The buyers have started coming back and cement and steel sectors have also started improving, he said. In fact, SBI's decision to cut the rates forced other banks to follow suit, he added.

Bhatt does not think Indian economy had been affected by global recession. "The recession did not hit India the way it had affected European countries last year. There was only a slowdown in the growth rate which came down to 7% from 9%," he said.

Replying to a question on withdrawal of stimulus package by the government in the prevailing situation, Bhatt said it should not be taken back but 'phased out' in staggered manner.

Referring to the ongoing merger process of SBI associate banks, Bhatt said SBI is a major stakeholder in SBI associate banks like State Bank of Saurashtra and State Bank of Indore. "In fact, we did not have less than 75% stake in any of these banks and owned 100% in State Bank of Hyderabad and State Bank of Patiala which were with us for the last 50 to 60 years," he said.

State Bank of Saurashtra has merged while process was on in regard to State Bank of Indore, Bhatt said. The merger would improve SBI in terms of efficiency in operation, release of capital.

Tuesday, December 29, 2009

AIABOF to continue fight against bank merger plan

| BS Reporter / Kolkata/ Berhampur December 29, 2009, |

All India Andhra Bank Officers’ Federation (AIABOF) has strongly opposed the government’s move to consolidate and merge the public sector banks (PSB) in the country and vowed to fight against it.

Stating that the move will destabilize the public sector fabrics of the banks, the general secretary of the AIABOF K.Ramakoteswar Rao said the merger and consolidation of the PSBs was not necessary when almost all the banks were earning profit and making good business.

“Despite the global economic meltdown, the Indian banking industry is doing well and earning profit and there is no need to merge or consolidate the PSBs in the country” said the president of the AIABOF, N.Raja Gopal Reddy. “We oppose it and will fight against the government’s decision” said Rao. He was addressed at the conference of the Berhampur unit of the AIABOF here on Sunday. The Andhra Bank officers from different parts of Orissa and Andhra Pradesh attended the conference. The president of the AIABOF presided.

Fraud case against Yes Bank employee

Tuesday, December 29, 2009

In 2007 along with her superior approached Rajesh Rathi, a MD of Gandhinagar-based MGD Electronics, and suggested him to invest in mutual funds through the bank's wealth management services. He agreed and a total of Rs 1 crore was invested in four funds in December 2007. The mutual funds were in the name of the company.

When Rajesh came to know about the fraud he approached the police. But police refused to register a case. Then MGD Electronics moved the court. In view of this Gandhinagar court passed an order in a case of alleged forgery against Shruti Panchal. She had forged the signature of Rajesh Rathi, also prepared a duplicate company seal, changed bank mandates with forged signatures and the seal, and cash in money invested in mutual funds worth about Rs 66 lakh.

The court has also instructed the police to investigate other unnamed bank officers as there is possibility that she might have committed fraud with the help of other people. The court stated that people keep their money in banks as they find it safe, but due to such cases people can loose confidence in banks.

MGD Electronics has also filed a case against Yes Bank in consumer court. The next hearing of the case will be held on January 19.

by J. Prasad

Thursday, December 17, 2009

Bank Merger:Strike cripples banks partially

Sachin Dravekar, 17 December 2009,

NAGPUR: Banking services were partially affected on Wednesday

following the strike called by Left-affiliated unions All

India Bank Employees ofAssociation AIBEA and

All India Bank Officers Association (AIBOA).

The union has been protesting against the move to merge State

Bank of Indore with its parent organisation State Bank of India.

Though employees from clerical grade remained absent in large

numbers, as the AIBEA has prominent presence in this cadre,

routine transactions could be carried out partially with

the help of members of other unions. Institutions like Bank

of Baroda and Canara Bank, where AIBEA of AIBOA do not have

a sizeable presence, were seen working. So were the ATMs

of both private and public sector banks including those

affected by the strike.

Interestingly, the Bank of Maharashtra (BoM) kept a window

open to sell tickets for the December 18 one-day international

to be played at Nagpur.

Cheque clearing, which is the first casualty during such an event,

was partially effected during the strike. Out of the 50,000 cheques

on an average daily, 33,196 cheques were presented in the

Reserve Bank of India's (RBI's), national clearing cell on Wednesday. T

he cheques valued at Rs 150 crore in all, as against those

valuing Rs 200 crore being presented on a normal day.

The MICR centre, which assorts the cheques below Rs 1 lakh,

did not function at all. The centre run by Punjab National Bank (PNB),

processes around 50,000 cheques in a day. A trip around the regional

offices of PSU banks showed a skeletal staff manning the workplaces.

"Around 80% of staff is affiliated to the AIBEA, so the work has

almost come to a standstill," said an official at the Bank of India.

Source:pti

NAGPUR: Banking services were partially affected on Wednesday

following the strike called by Left-affiliated unions All

India Bank Employees ofAssociation AIBEA and

All India Bank Officers Association (AIBOA).

The union has been protesting against the move to merge State

Bank of Indore with its parent organisation State Bank of India.

Though employees from clerical grade remained absent in large

numbers, as the AIBEA has prominent presence in this cadre,

routine transactions could be carried out partially with

the help of members of other unions. Institutions like Bank

of Baroda and Canara Bank, where AIBEA of AIBOA do not have

a sizeable presence, were seen working. So were the ATMs

of both private and public sector banks including those

affected by the strike.

Interestingly, the Bank of Maharashtra (BoM) kept a window

open to sell tickets for the December 18 one-day international

to be played at Nagpur.

Cheque clearing, which is the first casualty during such an event,

was partially effected during the strike. Out of the 50,000 cheques

on an average daily, 33,196 cheques were presented in the

Reserve Bank of India's (RBI's), national clearing cell on Wednesday. T

he cheques valued at Rs 150 crore in all, as against those

valuing Rs 200 crore being presented on a normal day.

The MICR centre, which assorts the cheques below Rs 1 lakh,

did not function at all. The centre run by Punjab National Bank (PNB),

processes around 50,000 cheques in a day. A trip around the regional

offices of PSU banks showed a skeletal staff manning the workplaces.

"Around 80% of staff is affiliated to the AIBEA, so the work has

almost come to a standstill," said an official at the Bank of India.

Source:pti

Governors Of RBI- Mr D Subbarao

| | Duvvuri Subbarao (born 11 August 1949) is a 1972 batch Indian Administrative Service (IAS) officer of Andhra Pradesh cadre. On 5 September 2008, he was appointed the 22nd Governor of Reserve Bank of India (RBI); his term will end in September 2011. Subbarao's hometown is Eluru, a small town near Vijayawada, Andhra Pradesh. He did his schooling from the Sainik School in Korukonda, Andhra Pradesh. He graduated in Physics[B.Sc Hons.] from Indian Institute of Technology Kharagpur (class of 1969) where he was the recipient of Director's Gold Medal. He received a [M.Sc] degree also in Physics from Indian Institute of Technology Kanpur. Subbarao topped the IAS examination in 1972 and was assigned the Andhra Pradesh cadre. He later did a Masters degree (MS) in economics from Ohio State University, United States and was a Humphrey Fellow at Massachusetts Institute of Technology. The years involved in each case are not publicly available at present. He later received a Ph.D. in Economics from Andhra University. The subject of his doctoral thesis at Andhra University is not publicly available at present; nor is the year of award. |

Tuesday, December 15, 2009

The Significance of the IMF-RBI Gold Sale

Much has been written in the last few days about the surprising purchase by the RBI (Reserve Bank of India) of some 200 tonnes of gold bullion, valued at about $6.7 billion, from the IMF (International Monetary Fund).

Is this really a significant event?

Is this really a significant event?

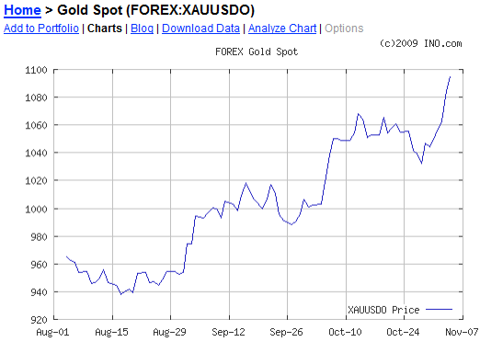

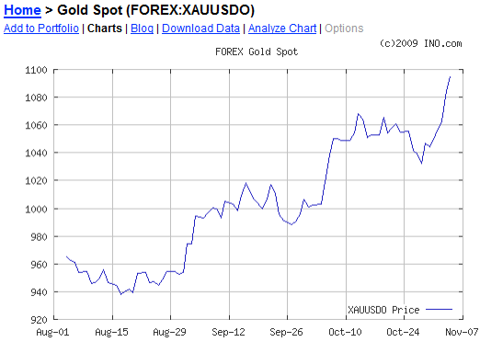

Judging by the price of gold since the announcement was made - up about $50 an ounce and showing no signs of stopping anytime soon - it certainly must have been significant.

But why?

The folks at the IMF, who, having long sought to rid themselves of some of their huge stash of gold bars in order to (purportedly) help balance their books and provide aid to underdeveloped countries, made a rather glib announcement about having put their financial house back in order, apparently unaware of how markets might react.

Being a fly-on-the-wall at IMF headquarters over the last few days would surely have provided some insight into this particular matter. However, it could well be that none of the economists and resident experts at the IMF even look at the price of gold, this metal having long ago lost its relevance in the minds of most bankers in a world full of paper money, fast computers, and sophisticated economic models that all failed so spectacularly over the last year.

Of course, the way the yellow metal is viewed by bankers and economists varies greatly depending upon what part of the world you are in. Surely, the Reserve Bank of India employs at least a few economists and they must have weighed in on the purchase.

Like the Chinese, they found the idea of more gold holdings to be irresistible.

We'll probably never know the many details that went into this decision. However, it certainly appears to be much more significant than the IMF conveyed in their press release.

A few thoughts as to why this is so are offered here.

The Delicious Timing of the Transaction

Had this deal been done, say, in March of next year or even during the last month or two of this year, markets would probably not have reacted as they did. As it was, within a few weeks of the IMF gold sale agreement being finalized in September, the gold sales began, wiping out an impressive half of the total authorized sale in very short order.

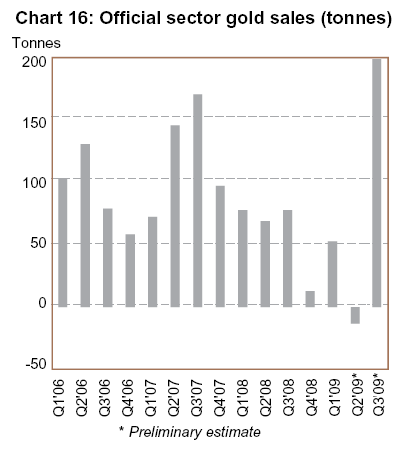

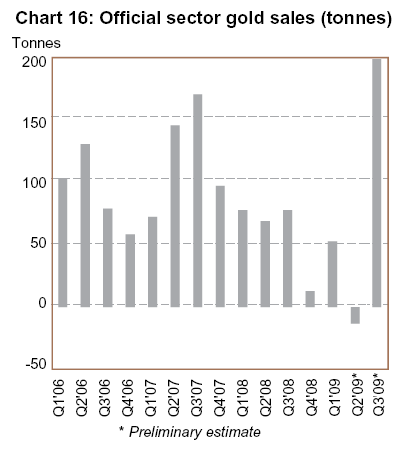

Since the IMF gold sales come under the umbrella of the recently renewed five-year European central bank gold sales agreement with a reduced cap of 400 tonnes per year (down from 500 tonnes per year in the prior agreement due to a dearth of sellers), the sale to India accounts for half of the entire 2009-2010 sales.

This is shown below in chart form, the IMF sales appended to the right of the graphic that appeared in the latest Gold Investment Digest from the World Gold Council.

After steady declines in recent years as European banks have reduced their gold sales, in comes the IMF to fill the void and - surprise! - the gold price skyrockets.

After steady declines in recent years as European banks have reduced their gold sales, in comes the IMF to fill the void and - surprise! - the gold price skyrockets.

Prior to the sale, there was much speculation that China would be the first buyer but, obviously, the RBI beat them to the punch and, while the IMF may not have realized it, this was one of the key reasons why markets are now in a tizzy.

This is a clear demonstration of how anxious at least one central bank is to exchange their paper money for something more tangible and the RBI neatly side-stepped the problem that any large buyer always has - driving up the market price while making their purchases.

To their credit, the RBI ended up driving prices higher after they were done buying.

India Purchased the Gold at Market Prices

A back-of-the-envelope calculation shows that the Indian central bank is now already up more than $300 million since buying their 200 tonnes of gold.

This is probably not what the IMF folks thought would happen and you can imagine the raised eyebrows of the staff when working out the deal where they probably figured they had hit the exact top of the gold price surge and what suckers the Indians were.

Press reports indicate that the RBI made their purchases between October 19th and 30th at an average price of $1,045 an ounce and, though it looks like they paid too much based on the chart below, they're still way ahead.

The relatively simple math is as follows: A gain of $50 an ounce is about a five percent rise in the gold price and a five percent rise in the RBI's $6.7 billion is a gain of about $335 million.

Of course, the gold price could go up or down from here, but any smirks that appeared on the faces of IMF staff as they were signing the paperwork were, obviously, premature.

Of course, the gold price could go up or down from here, but any smirks that appeared on the faces of IMF staff as they were signing the paperwork were, obviously, premature.

But, more importantly, what does this transaction say about the "value" of paper money and gold if a major central bank is so anxious to spend billions of dollars of the former to buy the latter at over $1,000 an ounce?

If the RBI felt strongly about boosting their gold reserves, why didn't they do it when gold traded at $400 or $500 an ounce a few years back, or even last year when it could be bought for between $800 and $900 an ounce?

European central banks have been selling the stuff for years at much lower prices and surely the Indian central bank could have boosted their reserves then. Why, they could even have bought some of the U.K.'s gold back in 1999 that was dumped on the market at $275 an ounce. Recall that Gordon Brown sold about half of England's 600 tonnes of gold at what is now known as the "Brown Bottom".

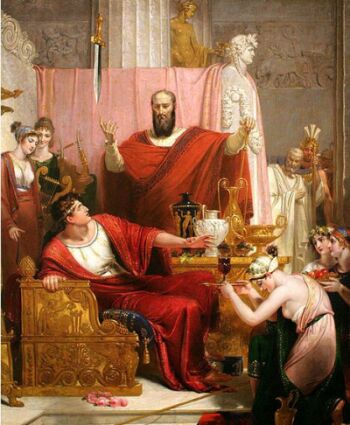

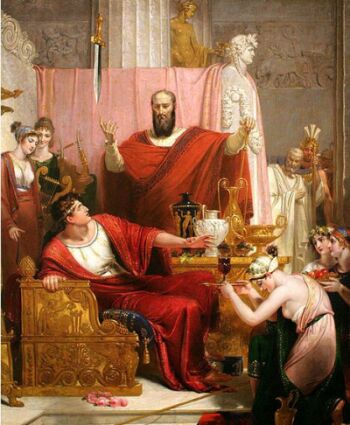

Removing the Sword of Damocles

Probably more important than any other factor in the IMF-RBI gold sale is the fact that the proverbial "Sword of Damocles" has been removed from the gold market after hanging there for years, suspended in mid-air, waiting to drop on any buyer of gold who was dumb enough to buy dumb 'ol gold coins when the IMF was about to flood the market with the stuff.

For years, Jim Rogers has been pointing to the looming IMF gold sales as the reason he thought the metal would underperform other commodities.

Well, it's still early, but initial indications are that, not only did the IMF gold sales not cause the gold price to plunge, these gold sales actually caused the price to soar.

Who would have known that when the IMF gold was finally offered up for sale that half of it would be gone within weeks and, more importantly, the buyer turned out to be someone other than the party that most market analysts were expecting.

Who would have known that when the IMF gold was finally offered up for sale that half of it would be gone within weeks and, more importantly, the buyer turned out to be someone other than the party that most market analysts were expecting.

For years, the prospect of European central banks and the IMF selling off their huge stockpiles of gold in the open market has been a big reason why buyers were understandably cautious. Analysts have been saying, "Even if the central banks stop selling, the IMF gold will be there to sate the appetite of buyers and that should keep a lid on prices."

So, the central banks have essentially stopped selling and now half the IMF gold is gone within weeks and China is probably already signing paperwork to buy the other half.

The Sword of Damocles is now gone, if it ever really was there.

A Sea Change in Central Bank Thinking

Perhaps the most provocative question that this gold sale has raised in the minds of other central bankers around the world is, "If India's buying, maybe we should be buying too".

As shown below, there are many countries that have woefully small gold reserves and, for better or worse, these same countries are also loaded to the gills with U.S. dollar denominated assets, some of which they'd now be more willing to exchange for gold bars after India has.

China, Japan, Russia, Taiwan and many other countries - mostly in Asia - are now sitting up in their chairs looking around at the other central banks in the world wondering who's going to be next to buy gold after India scored a cool $6.7 billion that quickly turned into a stash that is now worth $7.0 billion.

Surely, even the most dimwitted economists in Asian central banks are now tuned in to the rapidly changing landscape of global gold supply and demand.

Surely, even the most dimwitted economists in Asian central banks are now tuned in to the rapidly changing landscape of global gold supply and demand.

While economists in the West may cling to their "money is just a unit of account and gold is nothing special" way of thinking, central bank staff half way around the world are now starting to look at things very differently after the events of this week.

If inflation begins to heat up in the months ahead, then we might just see central banks scramble to buy gold along with the rest of the world.

In a pure fiat money system, there is nothing to back a national currency other than faith in the government that issues it and confidence in the central bank that prints it.

Oh yes, and the central bank's gold.

Even the IMF noted in a recent statement that its (still) massive gold reserves give its balance sheet a "fundamental strength".

Clearly, other central banks around the world, along with millions of investors, feel the need for this "fundamental strength" too.

Is this really a significant event?

Is this really a significant event?Judging by the price of gold since the announcement was made - up about $50 an ounce and showing no signs of stopping anytime soon - it certainly must have been significant.

But why?

The folks at the IMF, who, having long sought to rid themselves of some of their huge stash of gold bars in order to (purportedly) help balance their books and provide aid to underdeveloped countries, made a rather glib announcement about having put their financial house back in order, apparently unaware of how markets might react.

Being a fly-on-the-wall at IMF headquarters over the last few days would surely have provided some insight into this particular matter. However, it could well be that none of the economists and resident experts at the IMF even look at the price of gold, this metal having long ago lost its relevance in the minds of most bankers in a world full of paper money, fast computers, and sophisticated economic models that all failed so spectacularly over the last year.

Of course, the way the yellow metal is viewed by bankers and economists varies greatly depending upon what part of the world you are in. Surely, the Reserve Bank of India employs at least a few economists and they must have weighed in on the purchase.

Like the Chinese, they found the idea of more gold holdings to be irresistible.

We'll probably never know the many details that went into this decision. However, it certainly appears to be much more significant than the IMF conveyed in their press release.

A few thoughts as to why this is so are offered here.

The Delicious Timing of the Transaction

Had this deal been done, say, in March of next year or even during the last month or two of this year, markets would probably not have reacted as they did. As it was, within a few weeks of the IMF gold sale agreement being finalized in September, the gold sales began, wiping out an impressive half of the total authorized sale in very short order.

Since the IMF gold sales come under the umbrella of the recently renewed five-year European central bank gold sales agreement with a reduced cap of 400 tonnes per year (down from 500 tonnes per year in the prior agreement due to a dearth of sellers), the sale to India accounts for half of the entire 2009-2010 sales.

This is shown below in chart form, the IMF sales appended to the right of the graphic that appeared in the latest Gold Investment Digest from the World Gold Council.

After steady declines in recent years as European banks have reduced their gold sales, in comes the IMF to fill the void and - surprise! - the gold price skyrockets.

After steady declines in recent years as European banks have reduced their gold sales, in comes the IMF to fill the void and - surprise! - the gold price skyrockets.Prior to the sale, there was much speculation that China would be the first buyer but, obviously, the RBI beat them to the punch and, while the IMF may not have realized it, this was one of the key reasons why markets are now in a tizzy.

This is a clear demonstration of how anxious at least one central bank is to exchange their paper money for something more tangible and the RBI neatly side-stepped the problem that any large buyer always has - driving up the market price while making their purchases.

To their credit, the RBI ended up driving prices higher after they were done buying.

India Purchased the Gold at Market Prices

A back-of-the-envelope calculation shows that the Indian central bank is now already up more than $300 million since buying their 200 tonnes of gold.

This is probably not what the IMF folks thought would happen and you can imagine the raised eyebrows of the staff when working out the deal where they probably figured they had hit the exact top of the gold price surge and what suckers the Indians were.

Press reports indicate that the RBI made their purchases between October 19th and 30th at an average price of $1,045 an ounce and, though it looks like they paid too much based on the chart below, they're still way ahead.

The relatively simple math is as follows: A gain of $50 an ounce is about a five percent rise in the gold price and a five percent rise in the RBI's $6.7 billion is a gain of about $335 million.

Of course, the gold price could go up or down from here, but any smirks that appeared on the faces of IMF staff as they were signing the paperwork were, obviously, premature.

Of course, the gold price could go up or down from here, but any smirks that appeared on the faces of IMF staff as they were signing the paperwork were, obviously, premature.But, more importantly, what does this transaction say about the "value" of paper money and gold if a major central bank is so anxious to spend billions of dollars of the former to buy the latter at over $1,000 an ounce?

If the RBI felt strongly about boosting their gold reserves, why didn't they do it when gold traded at $400 or $500 an ounce a few years back, or even last year when it could be bought for between $800 and $900 an ounce?

European central banks have been selling the stuff for years at much lower prices and surely the Indian central bank could have boosted their reserves then. Why, they could even have bought some of the U.K.'s gold back in 1999 that was dumped on the market at $275 an ounce. Recall that Gordon Brown sold about half of England's 600 tonnes of gold at what is now known as the "Brown Bottom".

Removing the Sword of Damocles

Probably more important than any other factor in the IMF-RBI gold sale is the fact that the proverbial "Sword of Damocles" has been removed from the gold market after hanging there for years, suspended in mid-air, waiting to drop on any buyer of gold who was dumb enough to buy dumb 'ol gold coins when the IMF was about to flood the market with the stuff.

For years, Jim Rogers has been pointing to the looming IMF gold sales as the reason he thought the metal would underperform other commodities.

Well, it's still early, but initial indications are that, not only did the IMF gold sales not cause the gold price to plunge, these gold sales actually caused the price to soar.

Who would have known that when the IMF gold was finally offered up for sale that half of it would be gone within weeks and, more importantly, the buyer turned out to be someone other than the party that most market analysts were expecting.

Who would have known that when the IMF gold was finally offered up for sale that half of it would be gone within weeks and, more importantly, the buyer turned out to be someone other than the party that most market analysts were expecting.For years, the prospect of European central banks and the IMF selling off their huge stockpiles of gold in the open market has been a big reason why buyers were understandably cautious. Analysts have been saying, "Even if the central banks stop selling, the IMF gold will be there to sate the appetite of buyers and that should keep a lid on prices."

So, the central banks have essentially stopped selling and now half the IMF gold is gone within weeks and China is probably already signing paperwork to buy the other half.

The Sword of Damocles is now gone, if it ever really was there.

A Sea Change in Central Bank Thinking

Perhaps the most provocative question that this gold sale has raised in the minds of other central bankers around the world is, "If India's buying, maybe we should be buying too".

As shown below, there are many countries that have woefully small gold reserves and, for better or worse, these same countries are also loaded to the gills with U.S. dollar denominated assets, some of which they'd now be more willing to exchange for gold bars after India has.

China, Japan, Russia, Taiwan and many other countries - mostly in Asia - are now sitting up in their chairs looking around at the other central banks in the world wondering who's going to be next to buy gold after India scored a cool $6.7 billion that quickly turned into a stash that is now worth $7.0 billion.

Surely, even the most dimwitted economists in Asian central banks are now tuned in to the rapidly changing landscape of global gold supply and demand.

Surely, even the most dimwitted economists in Asian central banks are now tuned in to the rapidly changing landscape of global gold supply and demand.While economists in the West may cling to their "money is just a unit of account and gold is nothing special" way of thinking, central bank staff half way around the world are now starting to look at things very differently after the events of this week.

If inflation begins to heat up in the months ahead, then we might just see central banks scramble to buy gold along with the rest of the world.

In a pure fiat money system, there is nothing to back a national currency other than faith in the government that issues it and confidence in the central bank that prints it.

Oh yes, and the central bank's gold.

Even the IMF noted in a recent statement that its (still) massive gold reserves give its balance sheet a "fundamental strength".

Clearly, other central banks around the world, along with millions of investors, feel the need for this "fundamental strength" too.

"Punjab Bank Fraud case"-Pakistan

HAMESH KHAN Update: Bank of Punjab Ex-CEO Hamesh Khan

Arrested in U.S.

10 December 2009.

The former President of Bank of Punjab (BoP)

Hamesh Khan has been arrested and detained

in the United States.

The United States Department of Justice (DOJ)

confirmed it to the Pakistani government.

The Bank of Punjab (BoP) had granted a loan of

Rs 9 billion to the Haris Steel Industries (HSI)

without fulfilling the legal requirements and the

HSI subsequently defaulted on the loan.

The bank then filed a petition against HSI

and made BoP ex-President accomplice in the

transaction – a charge its then President and

CEO Hamesh Khan denies to-date calling it

"witch-hunting" and "politically motivated".

The Spokesman of National Accountability Bureau (NAB),

Ghazni Khan, Thursday confirmed Hamesh Khan’s arrest

in the United States saying that the US Justice Department

had also informed the Pakistani government in writing of

his arrest and detention.

The Supreme Court of Pakistan had directed the federal

government to arrest or have arrested,

the former President of Bank of Punjab Hamesh Khan,

who is said to be involved in billions of rupees of

fraud case.

In pursuance of the Supreme Court orders, Islamabad

approached the Interpol and the US government for his

arrest, the NAB spokesman said.

Hamesh Khan was allegedly involved in Rs 9 billions

fraud, but he fled from the country in June this year

despite his name being on the Exit Control List (ECL)

of the Interior Ministry which bars people from leaving

the country.

Hamesh Khan would be brought back to the country after

completion of formal legal proceedings and important

documentations, the NAB spokesman said.

Earlier, on the directives of Supreme Court of Pakistan,

a special team of National Accountability Bureau (NAB)

arrested main culprits of PunjabBank Fraud case,

Sheikh Muhammad Afzal with his son Haris Afzal of

Haris Steel Mills through the use of Interpol from Kuala-Lumpur,

capital of Malaysia on November 16.

Other suspects industrialist Seth Yaqoob and his daughter

Irum Yaqoob have also been detained and their assets frozen.

(MAMOSA)

Source:desperses

Arrested in U.S.

10 December 2009.

The former President of Bank of Punjab (BoP)

Hamesh Khan has been arrested and detained

in the United States.

The United States Department of Justice (DOJ)

confirmed it to the Pakistani government.

The Bank of Punjab (BoP) had granted a loan of

Rs 9 billion to the Haris Steel Industries (HSI)

without fulfilling the legal requirements and the

HSI subsequently defaulted on the loan.

The bank then filed a petition against HSI

and made BoP ex-President accomplice in the

transaction – a charge its then President and

CEO Hamesh Khan denies to-date calling it

"witch-hunting" and "politically motivated".

The Spokesman of National Accountability Bureau (NAB),

Ghazni Khan, Thursday confirmed Hamesh Khan’s arrest

in the United States saying that the US Justice Department

had also informed the Pakistani government in writing of

his arrest and detention.

The Supreme Court of Pakistan had directed the federal

government to arrest or have arrested,

the former President of Bank of Punjab Hamesh Khan,

who is said to be involved in billions of rupees of

fraud case.

In pursuance of the Supreme Court orders, Islamabad

approached the Interpol and the US government for his

arrest, the NAB spokesman said.

Hamesh Khan was allegedly involved in Rs 9 billions

fraud, but he fled from the country in June this year

despite his name being on the Exit Control List (ECL)

of the Interior Ministry which bars people from leaving

the country.

Hamesh Khan would be brought back to the country after

completion of formal legal proceedings and important

documentations, the NAB spokesman said.

Earlier, on the directives of Supreme Court of Pakistan,

a special team of National Accountability Bureau (NAB)

arrested main culprits of PunjabBank Fraud case,

Sheikh Muhammad Afzal with his son Haris Afzal of

Haris Steel Mills through the use of Interpol from Kuala-Lumpur,

capital of Malaysia on November 16.

Other suspects industrialist Seth Yaqoob and his daughter

Irum Yaqoob have also been detained and their assets frozen.

(MAMOSA)

Source:desperses

Situation of fake currency ‘alarming’, says Pranab Mukherjee

15 December 2009,

NEW DELHI: Government today admitted that the problem of

fake currency was "alarming and dangerous" as some groups

are trying to destabilise the

Indian economy by injecting massive doses of counterfeit

notes in the country.

"There are two kinds of groups, one is of individuals working

for profits, but much more dangerous is the effort of injecting

massive doses of fake notes in the country, trying to destabilise

the economy," finance minister Pranab Mukherjee said in Rajya Sabha.

In his written statement, Mukherjee also admitted that the security

breaches of the notes were last updated in 2005 while a committee

has been set up in this regard.

"The situation is alarming," he said answering supplementaries

during Question Hour.

But, it would take another two years before upgraded security

features are included in the currency notes, the minister said.

He said it would be difficult to quantify counterfeit currency

in circulation. "It is anybody's guess," he said, adding that

as per 2005 figures there are 48.9 billion pieces (of genuine currency)

in circulation and of these 0.001 per cent could be fake.

There is no authentic information about fake currency.

Mukherjee said he was not an "alarmist" as finance minister.

"I cannot afford to be one," he said, adding that more cases are

being detected, showing high alertness of government agencies.

Source:PTI

Monday, December 14, 2009

CA in Rs 1K cr money laundering racket

By : raj kumar makkad on 13 December 2009

Mumbai: The income tax (IT ) department in a raid on a

chartered accountant (CA) last week unearthed a money

laundering racket running into over Rs 1,000 crore.

The CA, Mukesh Choksi, through his several companies

generated fake bills showing share transactions in the

name of his customers who wanted to convert their black

money into white. The department also recovered a

pay order of 1 million and came across another onetime

transfer of Rs 10 crore in a private bank account.

A senior I-T official said, Choksis modus operandi was

innovative. He referred to the previous days share transactions

from newspapers and shortlisted scrips that witnessed huge trading

on the bourses. He then created fake broker notes of

intra-day trading on select shares, since these are

not reflected in the demat accounts.

Director of Investigation (I-T ) E T Lukose told TOI,

We have to do a lot of work in this case.

I am not in a position to disclose further details.

Choksi operated from a tiny air-conditioned garage

in Santa Cruz (E). He managed the entire operations

with just five computers, the official added.

He floated around 26 companies through which he

falsely claimed to have carried out share

transactions with the customers.

These companies existed only on paper .

He operated across the country through his

agents, who were mostly CAs or I-T practioners,

the official said. The department has recovered

documents containing the names of the people who

availed of his services. We are yet to reach to

the beneficiaries , Lukose said.

The cash that came from the beneficiaries was deposited

in the bank accounts of one of Choksis companies.

A cheque towards the said amount isdeposited

into the account of his another company .

The second company issues a cheque in the name

of the beneficiary. The beneficiary shows the money

as gains made from the share transactions where Choksis

companies acted as share brokers.

Choksi deducted a commission

for the services rendered , a source said. In one transaction,

officials came across a cash deposit of Rs 10 crore

in the private bank account of his company in Karnatakas

Mandya branch. The money got transferred to another account

in Mumbai for issue of pay order in favour of a charitable

organsiation in Chennai. However, the transaction got cancelled

and the money was returned to the Mandya account and was withdrawn

on the same day. We are investigating this too, the senior official

said. Sources said that Choksi had come under the scanner

twice in 2001-02 and again four years later in

connection with similar transactions. SEBI had imposed

a ban on him from operating in the market.

Mumbai: The income tax (IT ) department in a raid on a

chartered accountant (CA) last week unearthed a money

laundering racket running into over Rs 1,000 crore.

The CA, Mukesh Choksi, through his several companies

generated fake bills showing share transactions in the

name of his customers who wanted to convert their black

money into white. The department also recovered a

pay order of 1 million and came across another onetime

transfer of Rs 10 crore in a private bank account.

A senior I-T official said, Choksis modus operandi was

innovative. He referred to the previous days share transactions

from newspapers and shortlisted scrips that witnessed huge trading

on the bourses. He then created fake broker notes of

intra-day trading on select shares, since these are

not reflected in the demat accounts.

Director of Investigation (I-T ) E T Lukose told TOI,

We have to do a lot of work in this case.

I am not in a position to disclose further details.

Choksi operated from a tiny air-conditioned garage

in Santa Cruz (E). He managed the entire operations

with just five computers, the official added.

He floated around 26 companies through which he

falsely claimed to have carried out share

transactions with the customers.

These companies existed only on paper .

He operated across the country through his

agents, who were mostly CAs or I-T practioners,

the official said. The department has recovered

documents containing the names of the people who

availed of his services. We are yet to reach to

the beneficiaries , Lukose said.

The cash that came from the beneficiaries was deposited

in the bank accounts of one of Choksis companies.

A cheque towards the said amount isdeposited

into the account of his another company .

The second company issues a cheque in the name

of the beneficiary. The beneficiary shows the money

as gains made from the share transactions where Choksis

companies acted as share brokers.

Choksi deducted a commission

for the services rendered , a source said. In one transaction,

officials came across a cash deposit of Rs 10 crore

in the private bank account of his company in Karnatakas

Mandya branch. The money got transferred to another account

in Mumbai for issue of pay order in favour of a charitable

organsiation in Chennai. However, the transaction got cancelled

and the money was returned to the Mandya account and was withdrawn

on the same day. We are investigating this too, the senior official

said. Sources said that Choksi had come under the scanner

twice in 2001-02 and again four years later in

connection with similar transactions. SEBI had imposed

a ban on him from operating in the market.

Barclays Bank Plc Banned from Issuing PNs: SEBI

12 December 2009

The Securities and Exchange Board of India (SEBI)

banned Barclays Bank Plc from issuing or otherwise

transacting in new Offshore Derivative Instruments (ODIs),

also known as participative notes, or PNs, for having previously

violated disclosure norms.

SEBI said the ban will be in effect “till such time as

Barclays satisfies SEBI that it has put adequate systems,

processes and controls in place to ensure true and correct

reporting of its ODI transactions to SEBI”.

It also directed Barclays to Promissory Notes

Bfurnish a certificate “from an auditor of international

standing” to this end.

ODIs or Promisory Notes are investment vehicles used

by overseas investors to buy into Indian stocks or derivatives

SEBI found irregularities in disclosures regarding

four ODIs issued on 15 December 2006, with shares of

Reliance Communications Ltd as underlying assets.

Barclays had reported these as being issued to UBS AG

when they were actually issued to Hythe Securities,

an entity regulated by the UK’s Financial Services Authority.

Subsequently, SEBI found that Hythe Securities had issued

them to Pluri Emerging Companies PCC Cell E Emerging Markets

Growth Fund. Here, too, SEBI found Barclays Bank guilty of

flouting rules, as issuers must report any onward issuance of ODIs.

A Barclays Bank spokesperson said the issue pertained to

Barclays Capital and said it was too late in the evening

to comment as they are yet to study the order.

The Securities and Exchange Board of India (SEBI)

banned Barclays Bank Plc from issuing or otherwise

transacting in new Offshore Derivative Instruments (ODIs),

also known as participative notes, or PNs, for having previously

violated disclosure norms.

SEBI said the ban will be in effect “till such time as

Barclays satisfies SEBI that it has put adequate systems,

processes and controls in place to ensure true and correct

reporting of its ODI transactions to SEBI”.

It also directed Barclays to Promissory Notes

Bfurnish a certificate “from an auditor of international

standing” to this end.

ODIs or Promisory Notes are investment vehicles used

by overseas investors to buy into Indian stocks or derivatives

SEBI found irregularities in disclosures regarding

four ODIs issued on 15 December 2006, with shares of

Reliance Communications Ltd as underlying assets.

Barclays had reported these as being issued to UBS AG

when they were actually issued to Hythe Securities,

an entity regulated by the UK’s Financial Services Authority.

Subsequently, SEBI found that Hythe Securities had issued

them to Pluri Emerging Companies PCC Cell E Emerging Markets

Growth Fund. Here, too, SEBI found Barclays Bank guilty of

flouting rules, as issuers must report any onward issuance of ODIs.

A Barclays Bank spokesperson said the issue pertained to

Barclays Capital and said it was too late in the evening

to comment as they are yet to study the order.

RBI to Tighten ECB Norms by Reintroducing Ceiling

12 December 2009

With improvement in the global credit markets and narrowing

of spreads, the Reserve Bank of India (RBI) decided today

to reintroduce the ceiling on interest rates that Indian

companies pay for external commercial borrowing.

The norms that take effect from January 2010, would permit

Indian companies to raise debt for three to five years by

paying up to 300 basis points above the London Inter-bank

Offered Rate (LIBOR). Those using the ECB window to raise

ECB-Bfunds for over five years would be allowed to pay up

to 500 basis points over Libor, RBI said in a communication

this evening.

RBI had lifted the restriction on ECBs in January, following

intensification of the global financial crisis after Lehman Brothers collapsed.

RBI also decided today to shut the special window that allowed

companies to buy back foreign currency convertible bonds to

reduce debt burden at the height of the global financial crisis.

The reintroduction of the cost ceiling and withdrawal of the

FCCB buyback facility are the latest in a series of rollbacks

RBI has introduced since the economic environment improved.

In late October, the central bank had decided to revert to

a statutory liquidity ratio of 25 per cent for Indian banks.

While the overall direction was to signal a check on excessive

inflows, RBI has eased ECB norms for telecom companies and

infrastructure-focused, non-banking finance companies.

In addition, companies engaged in the development of

integrated townships have been given another 12 months

(up to December 2010) to make use of the simplified norms

announced last year.

The simpler norms for telecom companies were an extension of

the October 2008 decision, when operators were allowed to use

ECBs to obtain 3G licenses. Now, they have been permitted to

use the route for payment of spectrum allocation, too.

A senior executive at a leading foreign bank said RBI was

signalling, through today’s moves, to check excessive flow

of capital into the country. “The high capital flows through

ECBs, FCCB and portfolio investment have pushed up the value

of the rupee against the US dollar. Another message is that

only high-quality companies should tap the overseas market,”

the executive said.

With improvement in the global credit markets and narrowing

of spreads, the Reserve Bank of India (RBI) decided today

to reintroduce the ceiling on interest rates that Indian

companies pay for external commercial borrowing.

The norms that take effect from January 2010, would permit

Indian companies to raise debt for three to five years by

paying up to 300 basis points above the London Inter-bank

Offered Rate (LIBOR). Those using the ECB window to raise

ECB-Bfunds for over five years would be allowed to pay up

to 500 basis points over Libor, RBI said in a communication

this evening.

RBI had lifted the restriction on ECBs in January, following

intensification of the global financial crisis after Lehman Brothers collapsed.

RBI also decided today to shut the special window that allowed

companies to buy back foreign currency convertible bonds to

reduce debt burden at the height of the global financial crisis.

The reintroduction of the cost ceiling and withdrawal of the

FCCB buyback facility are the latest in a series of rollbacks

RBI has introduced since the economic environment improved.

In late October, the central bank had decided to revert to

a statutory liquidity ratio of 25 per cent for Indian banks.

While the overall direction was to signal a check on excessive

inflows, RBI has eased ECB norms for telecom companies and

infrastructure-focused, non-banking finance companies.

In addition, companies engaged in the development of

integrated townships have been given another 12 months

(up to December 2010) to make use of the simplified norms

announced last year.

The simpler norms for telecom companies were an extension of

the October 2008 decision, when operators were allowed to use

ECBs to obtain 3G licenses. Now, they have been permitted to

use the route for payment of spectrum allocation, too.

A senior executive at a leading foreign bank said RBI was

signalling, through today’s moves, to check excessive flow

of capital into the country. “The high capital flows through

ECBs, FCCB and portfolio investment have pushed up the value

of the rupee against the US dollar. Another message is that

only high-quality companies should tap the overseas market,”

the executive said.

RBI is keeping a Vigil on Capital Inflows

13 December 2009

The Reserve Bank of India (RBI) allayed concerns about

capital inflows building an asset bubble and said it

is keeping a vigil on these.

“If there is too much liquidity, it has the potential

for asset price build-up,” RBI Governor D Subbarao said.

However, “every asset price build-up need not necessarily

result in a bubble”, he told reporters after a meeting of

RBI’s central board of directors here.

Subbarao said that capital inflows were in line with the

country’s requirement. The surge in capital Capital

Inflowflows was not like as what happened between 2006-08,

he said, adding “If and when there is excess of capital flows,

we will have to respond to that situation.”

Subbarao said it was not possible at this point of time to

speculate on what if anything the apex bank would do to contain

the quantum of capital inflows.

The RBI yesterday tightened the guidelines for corporates

raising resources from external commercial borrowings.

Subbarao said corporates were now able to raise resources

from non-debt sources. On loan growth, Subbarao said that

credit offtake would grow. He said non-food credit demand

had grown by 10.4 per cent.

On the ECB guidelines, Deputy Governor Shyamala Gopinath

said these were relaxed during the time of economic crisis.

“Spreads had gone up at that point of time.” But with things

coming back to normal, the spreads had now narrowed.

“So we have reverted to what was there prior to the relaxation,”

Gopinath said.

The Reserve Bank of India (RBI) allayed concerns about

capital inflows building an asset bubble and said it

is keeping a vigil on these.

“If there is too much liquidity, it has the potential

for asset price build-up,” RBI Governor D Subbarao said.

However, “every asset price build-up need not necessarily

result in a bubble”, he told reporters after a meeting of

RBI’s central board of directors here.

Subbarao said that capital inflows were in line with the

country’s requirement. The surge in capital Capital

Inflowflows was not like as what happened between 2006-08,

he said, adding “If and when there is excess of capital flows,

we will have to respond to that situation.”

Subbarao said it was not possible at this point of time to

speculate on what if anything the apex bank would do to contain

the quantum of capital inflows.

The RBI yesterday tightened the guidelines for corporates

raising resources from external commercial borrowings.

Subbarao said corporates were now able to raise resources

from non-debt sources. On loan growth, Subbarao said that

credit offtake would grow. He said non-food credit demand

had grown by 10.4 per cent.

On the ECB guidelines, Deputy Governor Shyamala Gopinath

said these were relaxed during the time of economic crisis.

“Spreads had gone up at that point of time.” But with things

coming back to normal, the spreads had now narrowed.

“So we have reverted to what was there prior to the relaxation,”

Gopinath said.

RBI Circular on KYC Norms, AML Standards and Combating of Financing of Terrorism

Dec 13, 2009 RBI

RBI/2009-10/253 – December 10, 2009

RPCD.CO RRB.No 6557/03.05.28-A/2009-10

Know Your Customer (KYC) Norms/Anti-Money Laundering (AML)

Standards/Combating of Financing of Terrorism (CFT)

Please refer to our letter RPCD.CO.RRB.No.5451/03.05.28-A/2009-10 dated

November 16, 2009 on risks arising from the deficiencies in AML/CFT

regime of Iran,Uzbekistan, Pakistan, Turkmenistan, Sao Tome and Principe.

2. Financial Action Task Force (FATF) has issued a further Statement

dated October 16, 2009 on the subject (copy enclosed).

3. Regional Rural Banks are accordingly advised to take into account,

risks arising from the deficiencies in AML/CFT regime of Iran,

Uzbekistan, Pakistan, Turkmenistan and Sao Tome and Principe.

4. Please advise the Principal Officer of your bank to acknowledge

receipt of this circular letter to our Regional office concerned.

Yours faithfully,

(A.K.Pandey)

General Manager

RBI/2009-10/253 – December 10, 2009

RPCD.CO RRB.No 6557/03.05.28-A/2009-10

Know Your Customer (KYC) Norms/Anti-Money Laundering (AML)

Standards/Combating of Financing of Terrorism (CFT)

Please refer to our letter RPCD.CO.RRB.No.5451/03.05.28-A/2009-10 dated

November 16, 2009 on risks arising from the deficiencies in AML/CFT

regime of Iran,Uzbekistan, Pakistan, Turkmenistan, Sao Tome and Principe.

2. Financial Action Task Force (FATF) has issued a further Statement

dated October 16, 2009 on the subject (copy enclosed).

3. Regional Rural Banks are accordingly advised to take into account,

risks arising from the deficiencies in AML/CFT regime of Iran,

Uzbekistan, Pakistan, Turkmenistan and Sao Tome and Principe.

4. Please advise the Principal Officer of your bank to acknowledge

receipt of this circular letter to our Regional office concerned.

Yours faithfully,

(A.K.Pandey)

General Manager

Government steps forward to support public sector banks to merge

| 14-Dec-2009 |

| |

| Indian Finance Minister Pranab Mukherjee stated that Government will support public sector banks to merge, provided they fulfilled RBI and SEBI (Securities and Exchange Board of India) guidelines. “If someone decides to merge, if we see it is in conformity with our policy and if we find that parameters are being followed as per the SEBI and RBI guidelines”, then government would play a “supportive role”, he said in reply to a calling attention in the Lok Sabha. “The current policy of the government on consolidation leaves the initiative for consolidation to come from the management of the banks themselves, with the government playing a supportive role as the common shareholder,” he said, asserting that no directive on consolidation was being issued by the government or the RBI. The boards of the banks have to take a decision in this regard “based on the synergy levels of merging or consolidating entities”, he said. The attention motion was moved by CPI leader Gurudas Dasgupta who asked whether the government had taken any initiative “overtly or covertly” to merge various public sector banks resulting in “discontent” amongst the bank employees. Dasgupta gave the example of the move for merger of State Bank of India and State Bank of Indore. He also said the move was being opposed by the Madhya Pradesh government. He pointed out that there was no government interference in the normal day-to-day financial and commercial activities of the state-owned banks, he said, “We are giving them managerial autonomy. We cannot give them a directive that doesn’t merge.” Mukherjee said consolidation was a “continuous process” as mergers had occurred during “every regime”. Mentioning that the banking system had “undergone major changes” since nationalization, he said the State Banks of Travancore-Cochin, Bikaner and Saurashtra were doing a “good job” and were being optimistic to do better. Dasgupta said mergers would not only lead to monopoly and lower competition in the banking sector, it would also lead to dropping access to banking for the greater part of people. Source: Live Mint |

Saturday, December 12, 2009

The RBI may possibly order banks to limit their exposure in Mutual Funds

The Reserve Bank of India (RBI) may

The Reserve Bank of India (RBI) maypossibly order banks to limit their exposure in mutual funds

and also prescribe norms for such investments, in order to

tighten exposure and deploying funds indirectly in sectors or

companies to which banks cannot lend directly due to exposure limits.

Source:RBI

Friday, December 11, 2009

HSBC set to buy RBS India assets

Deal already signed for businesses in China, Malaysia too;

actual acquisition depends on regulatory sanctions

Mumbai: The Hongkong and Shanghai Banking Corp. Ltd, or HSBC,

is set to acquire the retail and small and medium enterprises

business of Royal Bank of Scotland Plc, or RBS, in India, China

and Malaysia.

HSBC entered the bidding race for select Asian assets of RBS

in October after talks between Standard Chartered Bank Plc and

RBS broke down over differences on the valuation of assets.

According to an RBS official in India, both the banks have

already signed the deal and the actual acquisition depends on

regulatory approvals in three countries.

RBS has already approached the Indian central bank for approval.

The key to the success of the Indian part of the acquisition is

the Reserve Bank of India (RBI) clearance for transfer of RBS

branch licences to HSBC.

RBS has 31 branches in India and employs 10,000 people, following

its 2007 acquisition of the Asian operations of ABN Amro Bank NV.

ABN Amro continues to conduct business in India under its original

name despite the RBS takeover. That acquisition was made through a

consortium, along with Fortis group of the UK and Banco Santander

SA of Spain. HSBC, which had an asset base of Rs94,620 crore in March,

operates through 47 branches across India. It has three more branch

licences granted by RBI.

Citibank NA is the largest foreign bank in India with an asset base of

Rs1.05 trillion in March, followed by Standard Chartered Bank with

Rs97,492 crore.

In June, RBI had declined to transfer RBS branch

licences to a prospective buyer. The banking regulator

based its decision on the fact that the proposed transaction

is a portfolio sale and not a bank buyout.

“We have signed a deal to sell our retail and small and

medium enterprises business in India, China and Malaysia

to HSBC,” a senior RBS official told Mint on condition of

anonymity as the proposal is yet to receive the regulator’s

approval. “We have sent the India proposal to the Reserve Bank

of India for approval,” the official added.

RBI spokeswoman Alpana Killawala said the central bank has

no information regarding the deal.

HSBC spokeswoman Malini Thadani declined to comment.

Responding to an email query, Vasantha Kumar, head of marketing

and communications, ABN Amro Bank, said: “RBS is in ongoing

discussions for the remaining retail and small and medium

enterprises assets it has decided to sell in Asia and will

make further announcements, as appropriate, in due course.”

RBS is selling businesses designated as non-core in select

markets to raise funds even though it will continue and grow

the corporate and wholesale banking activities of ABN Amro.

Madan Menon, country head, global banking and markets, ABN Amro Bank,

said, “Post the sale, the RBS group in India will focus on its core

business—corporate banking, markets and treasury, equity capital markets,

merger and acquisitions, syndicated loans, debt capital markets, trade

finance and cash payments... For the retail and SME (small and medium

enterprises) businesses, India will be the third largest employer within

the RBS group in the world.”

In February, RBS declared that it would move its India retail and commercial

banking operations, which employ 2,500 people, into a for-sale, non-core division.

Morgan Stanley is advising RBS on the sale.

In August, Australia and New Zealand Banking Group (ANZ) acquired RBS retail and

commercial banking operations in Taiwan, Singapore, Indonesia and Hong Kong for

around $550 million (Rs2,569 crore). It also acquired the onshore global banking

and markets (GBM) and global transaction services (GTS) operations in the Philippines,

Vietnam and Taiwan (excluding securities).

The talks with Standard Chartered Bank failed as the latter was not willing to

offer a little more than $100 million for the retail and commercial banking assets

of RBS minus the branch licences.

In fact, Standard Chartered worked on two sets of valuations—one exclusively for

the assets and the other for the assets and branches. This is because there was no

guarantee that RBI would permit the transfer of branch licences.

“The entire deal rests on the transfer of branches and it depends on what stance

RBI takes,” said an investment banker on condition of anonymity as he is associated

with the deal.

“The quality of the consumer banking assets is bad hence the only attraction for

HSBC is the branch network that it could acquire through this deal. RBS is trying

to convince the Indian banking regulator to transfer some branch licences to

the prospective buyers so that its existing clients receive uninterrupted service,”

added the same banker.

In India, the branch network plays a critical role when it comes to valuation as

foreign banks do not find it easy to secure licences even though RBI is quite

liberal in granting them. Under World Trade Organization norms, RBI is required

to issue 12 branch licences annually. It typically issues around 18 licences every

year but foreign banks want more.

ABN Amro Bank’s profits for the fiscal year ended 31 March in India

dropped 93.09% to Rs19.39 crore. The bank has written off debt worth

Rs962 crore in fiscal 2009, an almost three-fold increase from the

previous year’s Rs360 crore. Its consumer banking operations posted

an operating loss of Rs230.77 crore at the end of March. The size of

its consumer banking assets is not known.

HSBC India’s net profit for the fiscal year ended

March 2009 rose 8% to Rs1,291 crore.

Source: Sandeep Bhatnagar / Mint

actual acquisition depends on regulatory sanctions

Mumbai: The Hongkong and Shanghai Banking Corp. Ltd, or HSBC,

is set to acquire the retail and small and medium enterprises

business of Royal Bank of Scotland Plc, or RBS, in India, China

and Malaysia.

HSBC entered the bidding race for select Asian assets of RBS

in October after talks between Standard Chartered Bank Plc and

RBS broke down over differences on the valuation of assets.

According to an RBS official in India, both the banks have

already signed the deal and the actual acquisition depends on

regulatory approvals in three countries.

RBS has already approached the Indian central bank for approval.

The key to the success of the Indian part of the acquisition is

the Reserve Bank of India (RBI) clearance for transfer of RBS

branch licences to HSBC.

RBS has 31 branches in India and employs 10,000 people, following

its 2007 acquisition of the Asian operations of ABN Amro Bank NV.

ABN Amro continues to conduct business in India under its original

name despite the RBS takeover. That acquisition was made through a

consortium, along with Fortis group of the UK and Banco Santander

SA of Spain. HSBC, which had an asset base of Rs94,620 crore in March,

operates through 47 branches across India. It has three more branch

licences granted by RBI.

Citibank NA is the largest foreign bank in India with an asset base of

Rs1.05 trillion in March, followed by Standard Chartered Bank with

Rs97,492 crore.

In June, RBI had declined to transfer RBS branch

licences to a prospective buyer. The banking regulator

based its decision on the fact that the proposed transaction

is a portfolio sale and not a bank buyout.

“We have signed a deal to sell our retail and small and

medium enterprises business in India, China and Malaysia

to HSBC,” a senior RBS official told Mint on condition of

anonymity as the proposal is yet to receive the regulator’s

approval. “We have sent the India proposal to the Reserve Bank

of India for approval,” the official added.

RBI spokeswoman Alpana Killawala said the central bank has

no information regarding the deal.

HSBC spokeswoman Malini Thadani declined to comment.

Responding to an email query, Vasantha Kumar, head of marketing

and communications, ABN Amro Bank, said: “RBS is in ongoing

discussions for the remaining retail and small and medium

enterprises assets it has decided to sell in Asia and will

make further announcements, as appropriate, in due course.”

RBS is selling businesses designated as non-core in select

markets to raise funds even though it will continue and grow

the corporate and wholesale banking activities of ABN Amro.

Madan Menon, country head, global banking and markets, ABN Amro Bank,

said, “Post the sale, the RBS group in India will focus on its core

business—corporate banking, markets and treasury, equity capital markets,

merger and acquisitions, syndicated loans, debt capital markets, trade

finance and cash payments... For the retail and SME (small and medium

enterprises) businesses, India will be the third largest employer within

the RBS group in the world.”

In February, RBS declared that it would move its India retail and commercial

banking operations, which employ 2,500 people, into a for-sale, non-core division.

Morgan Stanley is advising RBS on the sale.

In August, Australia and New Zealand Banking Group (ANZ) acquired RBS retail and

commercial banking operations in Taiwan, Singapore, Indonesia and Hong Kong for