FE :REUTERS : MUMBAI, AUG 27 2013, 13:33 IST

Gold futures, which hit a record high on Tuesday, are likely to touch the keenly watched 33,000 rupees ($510) per 10 grams mark this week, as a weakening rupee could continue to make the dollar-quoted yellow metal expensive.

Higher gold prices could dent demand in the world's biggest buyer of the yellow metal, even as traders scramble for supplies after the federal government put a quota system on imports by linking exports with domestic consumption.

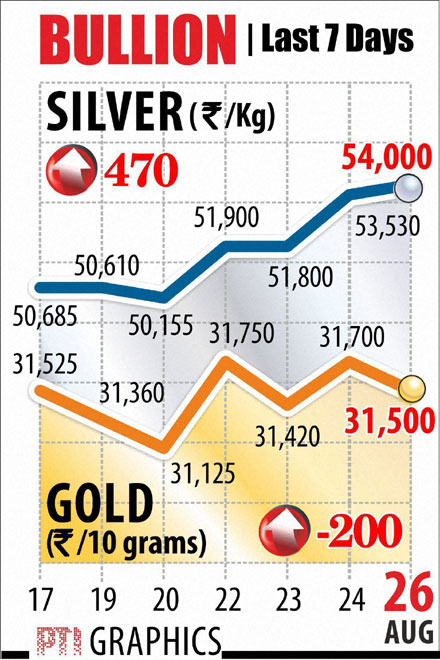

The most-active gold for October delivery on the Multi Commodity Exchange (MCX) was 2.11 percent higher at 32,549 rupees, after hitting a record of 32,677 rupees, breaching its previous record hit in November last year.

"The main reason would be rupee depreciation and high crude prices," said Gnanasekar Thiagarajan, director with Commtrendz Research.

The Indian rupee breached the 65.56 per dollar mark to hit a record low, as a steep decline in the domestic share market following the approval of the food security bill in the lower house of parliament hurt sentiment.

The rupee plays an important role in determining the landed cost of the dollar-quoted yellow metal.

Buying is advised on dips to 32,400 rupees, with a stop loss at 32,200, targeting 33,000, said Thiagarajan.

Silver for September delivery on the MCX was 2.54 percent higher at 55,155 rupees per kg.

Buying is advised in silver at 55,800 rupees, with a target at 57,000 rupees, and a stop loss at 55,100 rupees, said Thiagarajan.

No comments:

Post a Comment