Source :28 May 2010, 0638 hrs IST,Sugata Ghosh,ET Bureau

MUMBAI: The famously secretive Swiss private banks are trying to persuade Indians to bring back the money they have pulled out from their numbered accounts in these banks.

In the last one year, more than a hundred Indians with secret accounts have shifted money from Switzerland to banks in Dubai Free Trade Zone and Singapore amid fears of regulatory and government action.

“The Swiss banks are now reaching out to these clients to get back the funds they have lost. There’s no estimate of how much money has moved out, but it could be substantial in absolute terms,” said a senior Mumbai-based professional dealing in tax and cross-border transactions.

And interestingly, some of the account holders have moved back money to Swiss banks because of their long relationship with these private wealth managers. “But there’s a difference. The money that’s going back may not be parked in a numbered account. Instead, it could be a corporate deposit,” said a foreign exchange regulations expert who has advised clients on such fund transfers.

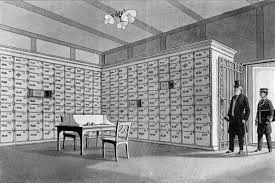

Individuals with numbered accounts have become used to a transaction convenience that is absent in most banking services.

While these accounts offer no interest and even charge a fee for holding the money, many depositors prefer them. The client does not have to write a cheque for any transaction, but simply call up a dedicated relationship manager and share a code given by the bank to complete the transaction.

“The manager uses a voice recorder to cross-check that the caller is indeed the holder of the numbered account. A client can call up from anywhere in the world to operate the account,” said a private money manager. According to him, clients draw comfort from the belief that in case of enquiries, the bank will do whatever it takes to protect the account holders’ identities. Till three years ago, these accounts offered an interest of 1-1.25%, but that has now stopped, he said.

It’s learnt that most of the money has been transferred to Dubai, where the transaction is in the nature of a trading receipt with a company set up in the free trade zone.

I-T notice to 50 on German list

The company receives a commission or consultancy fee. After a decent interval, the company in Dubai can open a new account with the Swiss bank to bring back the money. Some have transferred the funds to banks in Singapore, which, bankers say, is becoming the new destination for parking cash.

“Despite the stigma attached to Dubai, many still prefer it to Singapore for tax reasons. Some of the Swiss banks don’t have a branch in Dubai, so they want to get back such deposits. To them it’s free fund,” said the money manager.

Tax professionals as well as bankers know that legal complications make it difficult for governments and regulators to trace such fund flows. For instance, tax authorities have made little headway after Germany handed over names of secret account holders to Indian authorities.

Under Section 147 of the Income-Tax Act, the tax department can ask a person to file a return to take into account the income that has escaped assessment. However, under Section 148, the assessee can ask the department the reasons for reopening the file.

“It’s here that our I-T people will face a problem. Germany, as per the treaty with India, has told Indian authorities not to initiate proceedings against these people unless criminal actions or links are established. So, it would be difficult to pull them up unless the authorities can spot activities such terror funding, drug running, etc. Tax evasion is not a criminal offence,” said an income-tax expert.

So even though the income-tax department has sent notices to some 50 individuals a few months ago, it may end up achieving very little. Till then, the Swiss and other European banks will fish for clients and funds they have lost to other friendly, though less-efficient, offshore centres of the world.

No comments:

Post a Comment